The Spirits Market in Nigeria

Despite the recent economic difficulties, Nigeria’s spirits market has soared, boosted by growing youth interest and social media. Further, spirits sales, especially bitters have improved due to the changing dynamics in packaging. Sachet and small PET bottling make spirits affordable for many low-income earners, allowing established spirits brands to compete with options in the unregulated market. Nigeria has a large unregulated spirits market where non-compliant producers formulate drinks without regulatory guidelines.

Nevertheless, rising prices have shifted sales from premium to budget brands in the short term. 17% of the alcohol consumers interviewed in the study selected Spirits as the alcohol type they consumed the most in the week preceding the survey. While whiskey and vodka are some of the favorite Spirits for certain classes of alcohol consumers, there is a strong preference for bitters. Particularly, 38% of spirits consumers in the survey selected bitters as the spirits type, they consumed the most. Whiskey (15%) and Vodka (15%) were equally placed. Gin followed with 10% and all others at 22%.

Figure 4b: Types of Spirits Consumed

Source: Firmus Research

How much is a bottle of Spirits in Nigeria, and how much do Nigerians spend on Spirits?

Spirits prices vary widely across retail outlets, from costly imported brands to low-priced local blends. Prices of imported spirits, such as whiskey, gin, or vodka, can be as high as 100 X to 10,000 X of their local equivalent, depending on the brand’s prestige.

Figure 4b: Price of Spirits in Nigeria

Source: Firmus Research

The prices of domestically blended spirits in Nigeria can be even lower depending on the packaging type and size. The large unregulated spirits market in Nigeria prompted local spirits producers to introduce small and convenient packaging in sachets and PET bottles which is cheaper and able to compete well with the large informal and unregulated market. This has also increased accessibility of the different regulated spirits drink types by the common folks. Recent calls by NAFDAC to restrict the production of sachet and PET bottled spirits have got several players worried. With the current economic difficulties, many fear the unregulated market will eat their market share if these restrictions are implemented.

Like many other places in the world, drinks can be a status symbol in Nigeria. It is so pronounced that during events, different classes of drinks of the same category are served to different people depending on their social class. The recent economic challenges and consequent price hikes have made this even more pronounced causing retailers to be more creative in combining different drink types for their customers depending on their budget as well as the kind of guests expected at their events. This has also opened the market up to several low-cost options.

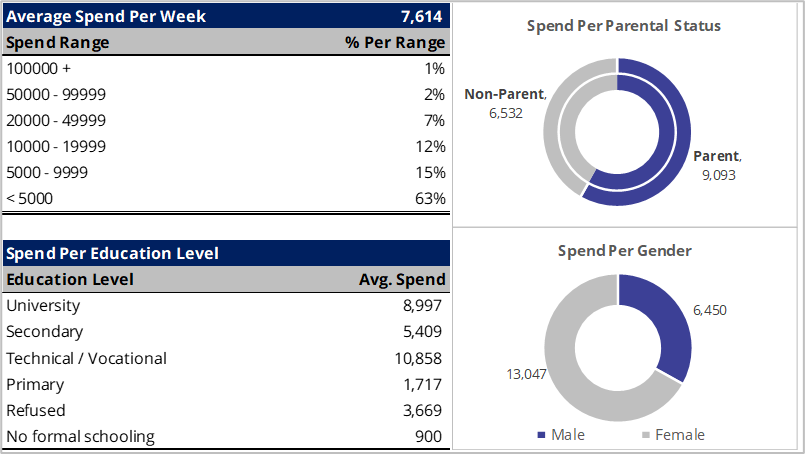

Despite the wide-ranging prices, the spending pattern in the market is of a pyramid structure where the majority of consumer spending is within the bottom range. Though on average, Nigerians spend more on Spirits than on beer – spending about ₦ 7614 per week on Spirits, most (63%) consumers spend less than ₦ 5000 a week. About 27% spend between ₦ 5,000 and ₦ 20,000 a week, while just 10% spend above ₦ 20,000 a week. People with no formal education spend far less on spirits, spending just an average of ₦ 900 a week, most likely purchased from the unregulated market or in smaller PET bottles. Interestingly, the survey recorded adults with children spending approximately 30% more on spirits than those without children. Also, females had a higher average spend than men as most of them selected imported brands as the brands they consume most. The figure below highlights the spending patterns of spirits consumers in Nigeria.

Figure 4c: Spend Patterns in Nigeria’s Spirits Market

Source: Firmus Research

What Spirits Brands Do Nigerians Drink the Most and Why?

The Spirits alcohol range is wide and varying, and Nigeria has it all: vodka, gin, rum, whisky, brandy, and the African favorite – bitters. Bitters is an herb-infused alcoholic preparation with a bittersweet flavor introduced into the Nigeria market in the early 2000s when the Ghanaian brand, Alomo bitters found its way to the market. Bitters has since become a Nigerian favorite. Action bitters topped consumer preference in the survey. Among the whiskey and vodka lovers, Jameson and Smirnoff topped, while Chelsea dry gin topped the preference chart for gin.

Like beer, taste is the strongest reason consumers select different spirits brands. 47% of consumers will choose a brand because they consider it to be tasty, whether in the smoothness of the drink or the type of aftertaste it leaves in the mouth of consumers. Apart from taste, is the perception of healthiness or the healthy ingredients a spirits drink contains. 17% of consumers are influenced by their perception of how healthy the drink is. This perception is common among bitters lovers who associate healthiness with bitters because of its herbal base. Some consumers also ascribe fat-burning properties to certain whiskeys and gin. Aside from taste and healthiness, 6% of consumers are influenced by the profile of flavors a brand offers. This was mostly the case for the Smirnoff Vodkas. Other reasons influencing consumer purchases are cheaper prices (6%), brand popularity, attractive packaging, and a drink’s ability to boost libido.

Figure 4d: Factors Influencing Spirits Brand Selection

Source: Firmus Research

Do Nigerians Always Stick to the Same Brand of Spirits or the Same Category?

Brand loyalty among Spirits consumers is slightly lower than among beer consumers. 54% of spirits consumers will stick to their preferred brands and will not easily be swayed. The remaining 46% can switch, though about half of this number often buy the same brand. The primary reason for sticking to a brand is taste; about 30% of consumers decide based on the product’s taste. Other reasons include the healthy components associated with a drink and the calming effects of the drink. Those who easily switch between brands mostly search for drinks that will make them feel good at any time and mostly choose from a list of preferences depending on their mood. A few also switch brands because of affordability; their preferred spirits drink may be too expensive to consume often.

Where Do Consumers Mostly Buy Spirits in Nigeria?

The Spirits market enjoys more off-trade sales than the beer market, with 77% of retailing done at off-trade markets. Supermarkets and malls lead off-trade sales with 43%. All the on-trade purchases happen in pubs and bars across the country.

Figure 4e: Favorite Spirits Purchase Points in Nigeria

Source: Firmus Research

What to Expect in the Nigerian Spirits Market

The growing youth interest in spirits will be sustained in the medium term, further strengthening growth. As manufacturers continue to respond innovatively to the price-sensitive spirits market, spirit’s share of the alcoholic beverage market is expected to increase. However, the recent notice by NAFDAC to ban sachet and PET bottling of spirit, if carried out, can significantly stagger the market growth. Market demand for premium brands will stabilize with the economy.

4.0 The Spirits Market in Nigeria

Despite the recent economic difficulties, Nigeria’s spirits market has soared, boosted by growing youth interest and social media. Further, spirits sales, especially bitters have improved due to the changing dynamics in packaging. Sachet and small PET bottling make spirits affordable for many low-income earners, allowing established spirits brands to compete with options in the unregulated market. Nigeria has a large unregulated spirits market where non-compliant producers formulate drinks without regulatory guidelines.

Nevertheless, rising prices have shifted sales from premium to budget brands in the short term. 17% of the alcohol consumers interviewed in the study selected Spirits as the alcohol type they consumed the most in the week preceding the survey. While whiskey and vodka are some of the favorite Spirits for certain classes of alcohol consumers, there is a strong preference for bitters. Particularly, 38% of spirits consumers in the survey selected bitters as the spirits type, they consumed the most. Whiskey (15%) and Vodka (15%) were equally placed. Gin followed with 10% and all others at 22%.

Figure 4b: Types of Spirits Consumed

Source: Firmus Research

How much is a bottle of Spirits in Nigeria, and how much do Nigerians spend on Spirits?

Spirits prices vary widely across retail outlets, from costly imported brands to low-priced local blends. Prices of imported spirits, such as whiskey, gin, or vodka, can be as high as 100 X to 10,000 X of their local equivalent, depending on the brand’s prestige.

Figure 4b: Price of Spirits in Nigeria

Source: Firmus Research

The prices of domestically blended spirits in Nigeria can be even lower depending on the packaging type and size. The large unregulated spirits market in Nigeria prompted local spirits producers to introduce small and convenient packaging in sachets and PET bottles which is cheaper and able to compete well with the large informal and unregulated market. This has also increased accessibility of the different regulated spirits drink types by the common folks. Recent calls by NAFDAC to restrict the production of sachet and PET bottled spirits have got several players worried. With the current economic difficulties, many fear the unregulated market will eat their market share if these restrictions are implemented.

Like many other places in the world, drinks can be a status symbol in Nigeria. It is so pronounced that during events, different classes of drinks of the same category are served to different people depending on their social class. The recent economic challenges and consequent price hikes have made this even more pronounced causing retailers to be more creative in combining different drink types for their customers depending on their budget as well as the kind of guests expected at their events. This has also opened the market up to several low-cost options.

Despite the wide-ranging prices, the spending pattern in the market is of a pyramid structure where the majority of consumer spending is within the bottom range. Though on average, Nigerians spend more on Spirits than on beer – spending about ₦ 7614 per week on Spirits, most (63%) consumers spend less than ₦ 5000 a week. About 27% spend between ₦ 5,000 and ₦ 20,000 a week, while just 10% spend above ₦ 20,000 a week. People with no formal education spend far less on spirits, spending just an average of ₦ 900 a week, most likely purchased from the unregulated market or in smaller PET bottles. Interestingly, the survey recorded adults with children spending approximately 30% more on spirits than those without children. Also, females had a higher average spend than men as most of them selected imported brands as the brands they consume most. The figure below highlights the spending patterns of spirits consumers in Nigeria.

Figure 4c: Spend Patterns in Nigeria’s Spirits Market

Source: Firmus Research

What Spirits Brands Do Nigerians Drink the Most and Why?

The Spirits alcohol range is wide and varying, and Nigeria has it all: vodka, gin, rum, whisky, brandy, and the African favorite – bitters. Bitters is an herb-infused alcoholic preparation with a bittersweet flavor introduced into the Nigeria market in the early 2000s when the Ghanaian brand, Alomo bitters found its way to the market. Bitters has since become a Nigerian favorite. Action bitters topped consumer preference in the survey. Among the whiskey and vodka lovers, Jameson and Smirnoff topped, while Chelsea dry gin topped the preference chart for gin.

Like beer, taste is the strongest reason consumers select different spirits brands. 47% of consumers will choose a brand because they consider it to be tasty, whether in the smoothness of the drink or the type of aftertaste it leaves in the mouth of consumers. Apart from taste, is the perception of healthiness or the healthy ingredients a spirits drink contains. 17% of consumers are influenced by their perception of how healthy the drink is. This perception is common among bitters lovers who associate healthiness with bitters because of its herbal base. Some consumers also ascribe fat-burning properties to certain whiskeys and gin. Aside from taste and healthiness, 6% of consumers are influenced by the profile of flavors a brand offers. This was mostly the case for the Smirnoff Vodkas. Other reasons influencing consumer purchases are cheaper prices (6%), brand popularity, attractive packaging, and a drink’s ability to boost libido.

Figure 4d: Factors Influencing Spirits Brand Selection

Source: Firmus Research

Do Nigerians Always Stick to the Same Brand of Spirits or the Same Category?

Brand loyalty among Spirits consumers is slightly lower than among beer consumers. 54% of spirits consumers will stick to their preferred brands and will not easily be swayed. The remaining 46% can switch, though about half of this number often buy the same brand. The primary reason for sticking to a brand is taste; about 30% of consumers decide based on the product’s taste. Other reasons include the healthy components associated with a drink and the calming effects of the drink. Those who easily switch between brands mostly search for drinks that will make them feel good at any time and mostly choose from a list of preferences depending on their mood. A few also switch brands because of affordability; their preferred spirits drink may be too expensive to consume often.

Where Do Consumers Mostly Buy Spirits in Nigeria?

The Spirits market enjoys more off-trade sales than the beer market, with 77% of retailing done at off-trade markets. Supermarkets and malls lead off-trade sales with 43%. All the on-trade purchases happen in pubs and bars across the country.

Figure 4e: Favorite Spirits Purchase Points in Nigeria

Source: Firmus Research

What to Expect in the Nigerian Spirits Market

The growing youth interest in spirits will be sustained in the medium term, further strengthening growth. As manufacturers continue to respond innovatively to the price-sensitive spirits market, spirit’s share of the alcoholic beverage market is expected to increase. However, the recent notice by NAFDAC to ban sachet and PET bottling of spirit, if carried out, can significantly stagger the market growth. Market demand for premium brands will stabilize with the economy.

Read about the Wine market in Nigeria