In Nigeria, a Tax Clearance Certificate (TCC) is an essential document for businesses, serving as proof of compliance with tax obligations. This certificate plays a crucial role in maintaining a business’s good standing with the authorities and ensuring eligibility for loans or grants. More so, the Nigerian government mandates Ministries, Departments and Agencies (MDAs), and commercial banks to request a copy of valid TCC from individuals and businesses in order to process their applications for licences, permits and certificates from the government.

In Nigeria, the TCC can be obtained from two major tax authorities federal tax authority (the Federal Inland Revenue Service-FIRS) and State tax authorities (the Lagos Inland Revenue Service-LIRS, OIRS, etc).

Benefits of Tax Clearance Certificate (TCC) in Nigeria

A Tax Clearance Certificate (TCC) is used for the following transactions:

Applying for government loans and grants

Bidding for contracts

Obtaining licenses and permits

Accessing subsidized goods and services offered by the government

Obtaining certificate of occupancy for landed property

Procedure for Obtaining a TCC from the Federal Inland Revenue Service (FIRS)

The FIRS is responsible for collecting taxes at the federal level, such as Corporate Income Tax (CIT), Value Added Tax (VAT), and Personal Income Tax (PIT) for certain individuals.

Here’s how to obtain a TCC from the FIRS:

Step 1 – Register with FIRS and ensure Tax Compliance

- Register with FIRS – If you haven’t already, register for tax with the FIRS and obtain a Tax Identification Number (TIN).

- File Tax Returns – File all necessary tax returns accurately and on time. This includes Company Income Tax (CIT) annual returns, Value Added Tax (VAT), Withholding Tax (WHT) and Personal Income Tax returns, as applicable typically for the past three years.

- Pay Taxes – Ensure that all taxes due are paid in full and on time.

Step 2 – Apply for the TCC

Once you are registered with FIRS and you have filed your taxes, you can apply for a TCC by either online and manual processes.

Below is the online Application procedure for existing Nigerian businesses.

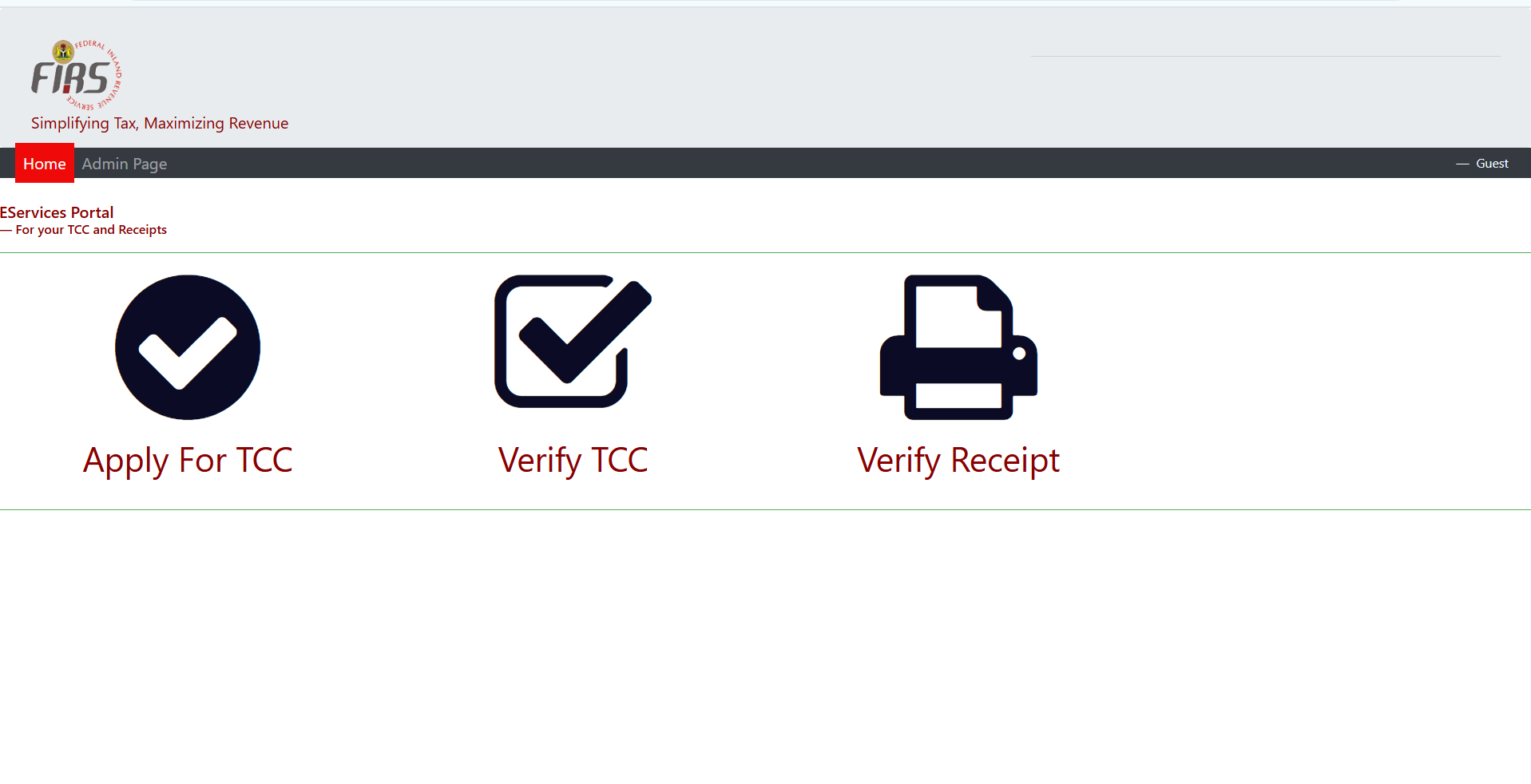

- Visit the FIRS TCC portal: https://tcc.firs.gov.ng

- Log in with your TIN and password

- Follow the instructions to generate and download your TCC

Apart from applying for a tax clearance certificate online, businesses can also apply manually for it by vising the nearest FIRS office. Below is a summary of the steps you need to take.

- Visit your nearest FIRS office.

- Request the TCC application form.

- Fill out the form accurately and completely.

- Submit the form along with the required documents, which may include: evidence of tax registration (TIN certificate), Copies of filed tax returns, Proof of tax payments, Other supporting documents as specified by the FIRS.

Processing and Issuance

The FIRS will review your application and verify your tax compliance status, if your application is approved, the FIRS will issue the TCC. For online application, TCC is issued immediately if application is successful but for manual application; the processing time may vary, but it typically takes a few weeks.

It is worthy to note that TCC is valid for one year from the date of issue.

Below is an image of FIRS TCC portal:

Obtaining a TCC from the State Internal Revenue Service

The Lagos Inland Revenue Service (LIRS) is responsible for collecting taxes at the state level in Lagos State, such as Personal Income Tax (PIT) for individuals who are residents of Lagos State and Pay-As-You-Earn (PAYE) tax deducted from employees’ salaries.

Here’s how to obtain a TCC from the LIRS:

1. Register with FIRS and ensure Tax Compliance

- Register with LIRS: If you haven’t already, register for tax with the LIRS and obtain a Tax Identification Number (TIN)

- File Tax Returns: File all necessary tax returns accurately and on time. This includes PIT returns and PAYE returns, as applicable.

- Pay Taxes: Ensure that all taxes due are paid in full and on time.

Step 2 – Apply for the TCC

A. Online Application:

- Visit the LIRS eTax portal: https://etax.lirs.net

- Log in with your TIN and password.

- Follow the instructions to apply for and download your TCC.

B. Manual Application:

- Visit your nearest LIRS office.

- Request the TCC application form.

- Fill out the form accurately and completely.

- Submit the form along with the required documents, which may include: evidence of tax registration (TIN certificate), copies of filed tax returns, proof of tax payments and other supporting documents as specified by the LIRS

Processing and Issuance

The LIRS will review your application and verify your tax compliance status, if your application is approved, the LIRS will issue the TCC. The processing time may vary depending on the peculiarities of the tax payer but it will typically not exceed one month.

Below is sample images of FIRS TCC:

Conclusion

Obtaining a Tax Clearance Certificate in Nigeria is a necessary process to confirm your tax compliance for a specific period. By following the outlined steps above, individuals and businesses can apply for their TCC from either FIRS or LIRS. Always ensure that all your tax obligations are fulfilled and that the required documents are accurately submitted to avoid delays in obtaining your certificate. Also, it is advisable to seek assistance from a tax professional as they are very much familiar with the tax-compliance terrain of Nigeria.

Also read on the Tax compliance for businesses in Nigeria